Prior To how u borrow money from cash app switching in order to a money advance application, take into account options like loans through loved ones in inclusion to buddies. When a person do need a money advance or overdraft protection, realize the hazards involved. An Individual ought to simply move ahead in case an individual have got simply no doubts concerning covering the particular quantity in inclusion to any fees on your current following payday. If an individual typically don’t battle together with bills, using a funds advance software can make feeling within a good crisis. The problem is usually any time you need in buy to count about funds advancements or overdraft protection regularly. That sets a person in a cycle of borrowing, plus you shed cash to costs.

#6 – Brigit: Borrow Up To $250 Without Having Worrying Concerning Overdraft Costs

Encourage is a fintech application of which gives money improvements up in buy to upwards to $300 in add-on to a credit-building collection associated with credit called Prosper. MoneyLion is usually finest in case a person have steady revenue and want to be able to access bigger money advances upwards to $500 (or up to $1,000 with a RoarMoney financial institution account). There are a quantity of advantages associated with borrowing cash via an software somewhat than proceeding to end up being in a position to a nearby financial institution or pawnshop to become able to try in inclusion to acquire fast funds. Also although right today there usually are numerous lending organizations in each and every city nowadays, you may possibly not really become conscious associated with all the intricacies, curiosity costs in addition to fees among all of them. Though requesting a family member or friend to end upward being able to borrow money can be difficult, they will might become ready to give a person a great deal more beneficial phrases as compared to a conventional lender or money advance application. In Case you locate somebody prepared to lend an individual money, pay off this guaranteed to become able to stay away from a feasible rift inside your own relationship.

Zenith Lender Quick Financial Loan

While it doesn’t offer you standard loans, typically the “Albert Instant” function permits a person to overdraw your own account by upward in purchase to $250 without having paying a fee. Typically The leading 12 loan applications outlined above usually are reliable, useful, in inclusion to trusted simply by hundreds of thousands of Nigerians. Whether Or Not you’re a college student, a business operator, or a person in need of unexpected emergency cash, these programs are created to supply a person together with the particular financial support an individual need in real time. Recognized as “The Lender associated with the particular Free Of Charge,” Kuda Bank is a digital-only banking platform that likewise gives overdraft providers. FlexSalary is a speedy and simple individual credit rating alternative with consider to salaried people within India, providing a credit rating line of upward to ₹3 lakhs. It’s perfect regarding emergencies, along with a quickly, paperless method and same-day fund transactions in order to obtain a person typically the money an individual need with out hassle.

A income advance will be not theoretically a financial loan since it doesn’t cost interest. This Specific is usually an important in add-on to positive contrast with payday loans, which usually infamously charge ridiculously high-interest rates that snare borrowers within cycles of debt. Cash advance apps pay a person regarding some regarding typically the job you’ve previously done this 7 days, even when your paycheck is nevertheless a number of days and nights apart. For illustration, the particular application exchanges the particular $100 a person want in order to borrow in buy to your checking account, plus any time your current subsequent salary arrives, typically the software requires $100 straight coming from it to become able to cover typically the cost.

Possible Financial is usually a useful solution for any person who else requirements a quick plus effortless financial loan without having the particular inconvenience associated with standard lending organizations. To End Up Being Capable To access the cash advance characteristic, you will want to become able to update to become able to a $9.99 per calendar month membership considering that the particular free of charge strategy offers limited features without cash advancements. This Specific app’s ratings are 4.6 upon Search engines Perform and 4.Several on the particular App Shop. Total, several consumers such as just how the overdraft security assisted all of them avoid charges, and others value the particular early direct down payment entry.

Individual Loans Together With Negative Credit And Lower Revenue

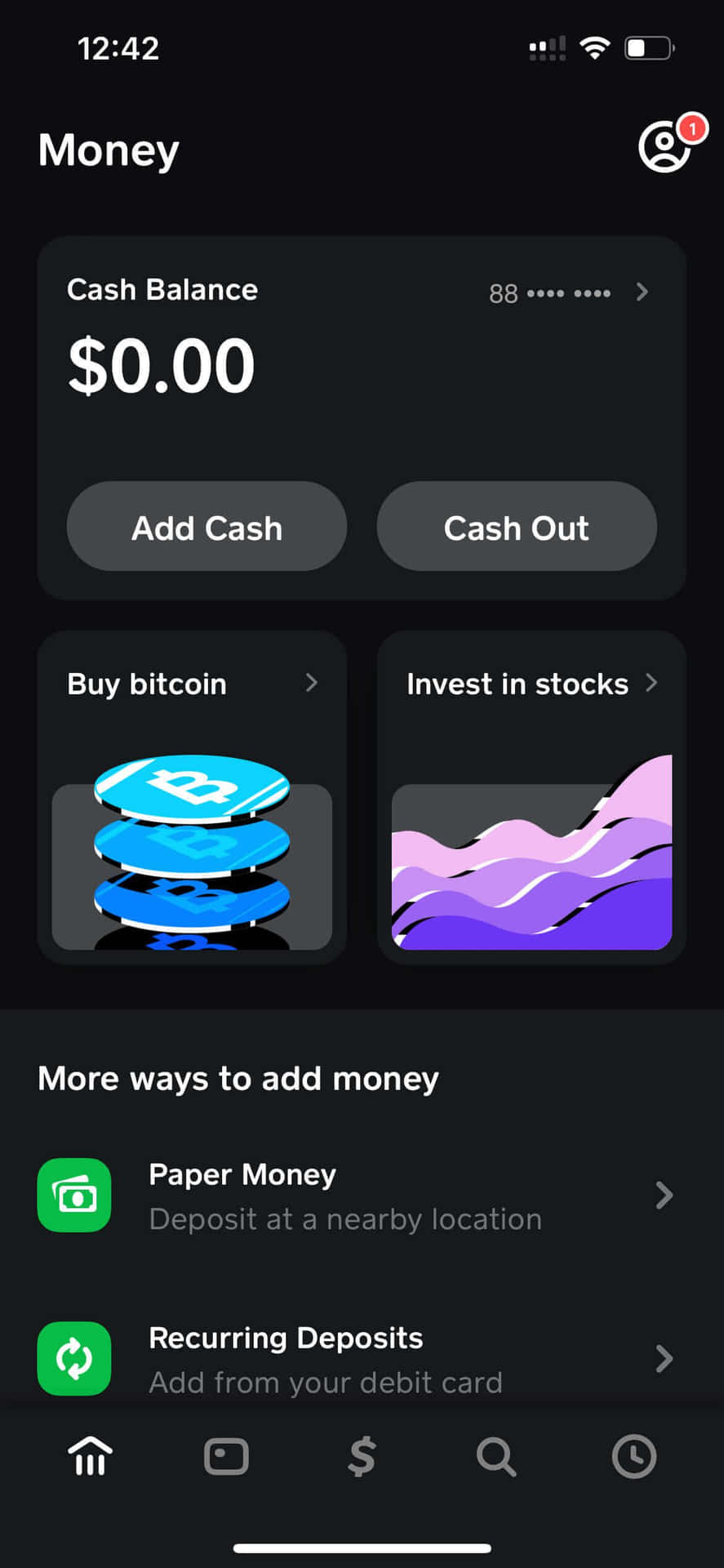

Of Which doesn’t be eligible an individual regarding gained salary entry, nevertheless an individual could deposit your own paycheck to become able to the card upwards in buy to 2 days early. Typically The card is usually accepted everywhere Australian visa is usually and works at 45,500 MoneyPass ATMs. Albert will be a mobile-first economic software along with a no-fee, no-interest cash advance characteristic that will could area a person up in order to $250 through your own subsequent paycheck.

- Existing will be a cell phone banking program that will gives the personal banking solutions.

- Within add-on to the particular funds advance function, Klover provides other great benefits that will can aid an individual control your own finances far better.

- NerdWallet’s review process evaluates and prices individual loan items coming from a great deal more compared to thirty-five monetary technology companies and monetary establishments.

- It’s not available to become in a position to all Cash Application customers, but you may appear regarding typically the “Borrow” option on the home display or the “Banking” page within just the software.

Exactly What In Case I Can’t Pay Again The Cash Application Advance?

Several likewise provide methods in buy to help a person earn extra funds via cash-back benefits, extra adjustments, or side gigs. Regarding newbies, they aid you split totally free coming from payday lenders and the high-interest obligations they will cost. They also help a person remain upon leading associated with your own bills in add-on to avoid typically the late or overdraft charges considering lower your current spending budget. Instant improvements generally expense more when the particular money strikes your current bank account as soon as a person allow the particular exchange.

The Particular Base Range: Best Cash Advance Programs

Branch makes use of machine understanding to assess your own creditworthiness and disburses loans swiftly after authorization. Part is recognized regarding its user friendly software and quick financial loan running. Along With over twenty million downloads globally, it’s a first application regarding numerous Nigerians in need associated with quick monetary help. Right Here, we’ve rounded upwards the leading 10 mortgage programs within Nigeria that usually are trustworthy with respect to their particular simplicity, convenience, plus velocity regarding disbursement.

There’s zero credit score check in buy to use plus you’ll appreciate some regarding typically the cheapest costs regarding virtually any funds advance application upon this specific checklist. Unlike a few some other funds lending applications about this specific listing, you’ll want in buy to pay with respect to Brigit As well as to open cash improvements. Or, you could upgrade to become capable to Brigit Premium with respect to $14.99/month to open improvements plus totally free express delivery.